Glorious uncertainty is a key appeal of any sport. The thrill and suspense is what cultivates audiences and keeps bringing them back. Take the climax of the ICC Cricket World Cup 2019 Final at Lords Cricket Ground, where New Zealand were determined to clinch their first ever title. But an incredible turn of events at the end and in the super-over, that included a lucky deflection that fetched the hosts four precious runs ended with Ben Stokes emerging as a hero for England helping them win their 1st ever World Cup. On that very same Sunday, Roger Federer and Novak Djokovic played out the longest ever Wimbledon’s Men’s singles final where Djokovic fought back from being down a Championship Point to clinch a thriller in the first ever super tie-break.

The odds on all of this transpiring were rather short indeed. Unexpected things happen all the time; in sport, they become entertaining, but in life, we often need protection against them. Which is why the insurance industry and the sporting industry seem to have had a long standing connection. And the time might be ripe for insurance companies in India to deepen their involvement with the platform.

Worldwide, from Allianz’s investment in stadium naming rights to American insurers spending more than half of their sponsorship budgets on sports, the insurance industry treats the sports platform as one of its key pillars in marketing. The Financial Times quoted Sebastian Smith, executive vice-president at Octagon who pointed out that “The insurance category is one of the busiest and most competitive in sports marketing.” In India, a burgeoning market with ample opportunity for growth, the push through this platform remains subdued.

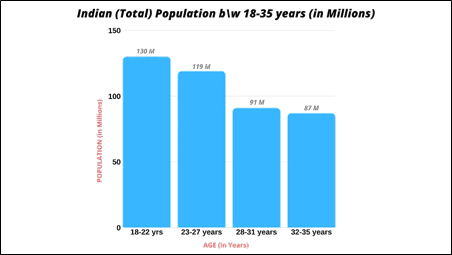

The Life Insurance vertical in India is projected to have a growth rate of 12-15% for the next 3-5 years. The trends driving that number is the fact that the demographics are favorable. India is densely populated with 1.37 Billion people, as per UN Data 2019. Out of this huge chunk, 420 million are within the age group of 18-35 years (See graphs), which is a potential target market for Indian Insurance Industry. With the rising popularity of Sports, Fitness & Wellness (SFW) activities, the market (India) has also started flourishing, as it was about $35 billion (2016) with an expectation to cross $90 billion by 2020.

In addition to that, the Global Sports Market is predicted to be about $614 Billion by 2022, and Indian Sports Market alone is expected to be a $10 Billion business by 2022. This sudden rise in the SFW market is assumed to be due to younger generations preference for healthier lifestyle, which by default is linked to the purpose of Insurance, “to be safe & secure whenever and wherever needed”.

That linkage is something brands have not leveraged as much. A lot of insurance marketing in India is through advertising and the involvement in sports also remains limited to on-air ad spot buys during high decibel sporting events (like, say, the ICC Cricket World Cup 2019). Insurance brands and operators (including agents, banks as well as comparison websites) may want to explore establishing a deeper and more emotional connect with these events. One brand that has tried it is IDBI.

Insurance as a term, itself has been under the radar with all the negative connotations associated with it as Karthik Raman, CMO-IDBI Federal Life Insurance, said in his interview when asked about IDBI Federal’s association with Sports (specifically Marathons & Sachin Tendulkar). “It is important to pump in lot of money, if you want to be heard or else your voice gets drowned”, he added.

Generally, in the global market particularly the American market, insurance and sports partnership has evolved to be long standing and deep seated with leading insurers associating with multiple sporting properties to enhance their reach. The Indian insurance and the sports market are at that inflection point where they are, driven by demographics, the scope for bridging the gap between awareness and action from the consumer through sports is tremendous. However, it will require consistency, commitment, and connect – the very same traits that ideally drive insurance planning too, while maintaining the integrity of the sport & being respectful all associated stakeholders.

India has always been in the premium category when it comes to investments particularly because of the target market, specifically the 18-35 age group. Association with sporting events has been an important marketing lever for all competitive brands, with cricket being the No.1 sport in terms of consumption in India along with football, kabaddi & badminton.

“Opportunities are like sunrises. If you wait too long, you miss them”

by William Arthur Ward.

This is one such opportunity with an untapped market, where the insurance giants can introduce interesting campaigns & schemes for players, teams/franchises or even national & state governing bodies (sports) to be exclusively connected with the brand for an everlasting experience and market capitalization. For example, the Directorate of Sports & Youth Welfare (DSYW), Madhya Pradesh has an athlete insurance system in place.

On the way to being a $10 Billion business, the sports industry may see franchises being owned or partnered by Insurance companies in the coming years with Public Private Partnership (PPP) model already being introduced in India by SE TransStadia “The Arena”. And while things like naming rights seem to be sometime off, the possibility of companies being associated with a sport in terms of event/series/tour sponsors definitely remains open and untapped.